Bills to Fix Gambling Tax Deduction Change Gaining Sponsors in the House

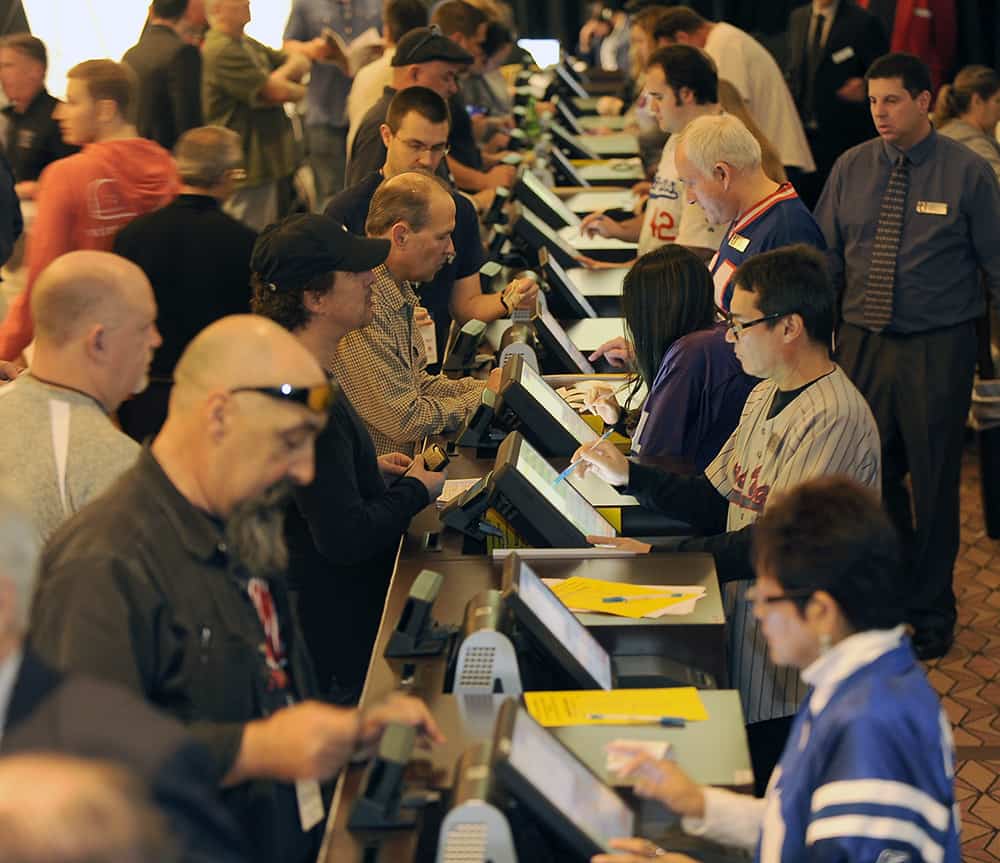

The centerpiece of the second Trump administration, the One Big Beautiful Bill Act (OBBBA), was signed into law on July 4th, 2025. However, one change made in the bill has caused an uproar on both sides of the aisle. The Senate changed the GOP reconciliation bill, specifically the gambling tax deduction, which was reduced to 90% from 100%. While this change would raise about $1 billion dollars for the government, it would also potentially tax gamblers on ‘phantom winnings’.

Luckily, lawmakers on both sides of the aisle and in both chambers of Congress heard the outcry regarding this bill, and multiple bills have been introduced to revert the gambling deduction back to 100%. Rep. Dina Titus (D-NV) has introduced the FAIR BET Act, which has multiple bipartisan co-sponsors, and Rep. Andy Barr (R-KY) has also introduced the WAGER Act.

It seems to be an issue that Washington wants to get fixed, as Rep. Jason Smith (R-MO), the chairman of the powerful Ways and Means Committee, made a statement in support of changing the deduction back: “For those of you concerned about this change, I can tell you that members on both sides of the aisle have heard you, and I know that many members on both sides of the aisle are open to working to address it before it goes into effect on January 1.”

The change doesn’t go into effect until 2026, so if lawmakers can come together on this issue before then, gamblers will notice no difference in their deduction. It remains to be seen what the timeline for this change is exactly or if the deduction will be reverted through one of the bills introduced into the House. But this level of awareness in Washington, with both sides of the aisle coming together, means progress is being made. The January 1st deadline means that lawmakers are extremely incentivized to get this change made before the new year.

We will keep you updated on the progress of these bills as they move through the House.

Trump Faces August 1st Tariff Deadline, Outline of Trade Agreements Announced

August 1st is President Trump’s most recent tariff deadline. At that time, “the president is set to impose another round of taxes on imports from many countries, including Canada and Mexico, with rates up to 50 percent,” according to the New York Times. These include new threats made in recent weeks, as well as the “Liberation Day” tariffs, which have been put on pause since their announcement in April. It remains to be seen if the President will push back his deadline again. In the past, he has extended his deadline each time the market started to wobble. He has already extended the tariff pause on China by 90 days.

In the meantime, the White House has been announcing a slow but steady stream of trade deals with various countries, though not quite on the 90 deals in 90 days pace the president claimed. It is important to note, as well, that the trade deals being announced don’t include the full text of the deals. Instead, these announcements are described as ‘preliminary agreements’. Notable agreements already announced include Britain, Indonesia, the Philippines, Vietnam, Japan, and the European Union.

When it comes to Mexico and Canada, the tariffs will only be in effect for goods not covered under the U.S.-Mexico-Canada trade agreement, which was previously signed during Trump’s first term.

Again from The Times: “These broad tariffs are separate from duties that Mr. Trump has imposed on specific imports and industries, including foreign cars and auto parts. Those tariffs also affect Canada and Mexico, with some key exceptions for products covered by U.S.M.C.A.”

The situation with tariffs will remain fluid, as the President uses them as a negotiating tactic rather than specific policy.

USDA Begins Major Reorganization Effort

The United States Department of Agriculture (USDA) announced a major reorganization effort on Thursday, July 24th. Currently, roughly 4,600 employees are working in the Washington, D.C. area. As part of Republican efforts to downsize federal workforces, about 2,600 of these employees will be relocated to one of five ‘hubs’ across the United States – anywhere from Utah to North Carolina.

The USDA announced that layoffs were possible, but only “if needed”. They also announced a plan in coordination with these relocations to vacate several D.C. office buildings. According to a release from the USDA, “USDA’s footprint in the National Capital Region (NCR) is underutilized and redundant, plagued by rampant overspending and decades of mismanagement and costly deferred maintenance.”

According to former acting USDA Secretary Kevin Shea, vacating these unused offices had been in the works for years, but the relocations had him concerned that, “[this] will drive more people to retirement, and it will drive people to other agencies in the D.C. area that aren’t exiling their employees.”

While it remains to be seen what effect this will have on the product of the USDA, the nonpartisan Government Accountability Office will have a report on the effect of the changes. They’ve done similar studies into the relocations of the Economic Research Service and the National Institute of Food and Agriculture.

In all, the major Republican governmental reorganization effort continues on.